29 November 2023

Why more action is needed from food businesses on health and the environment

This year at COP28, there is more focus on the impact of the food system and our diets on the climate crisis, with sessions taking place across the two weeks at the Food and Agriculture pavilion.

And quite rightly – the food system accounts for over a third of total annual greenhouse gas emissions, warming our planet and the extreme weather events we are witnessing more frequently.

However, instead of food businesses ramping up much-needed action towards a better food system, our 2023 State of the Nation’s Food Industry report shows that progress has slowed.

Fewer commitments to sustainable diets are being set in comparison to last year, and the same goes for key health commitments. Food businesses are failing to create a food environment where healthy and sustainable foods are affordable, readily available and appealing.

Drawing largely on our 2023 Plating Up Progress analysis, but also new research, the new report spotlights businesses from across all sectors (retailers and the Out of Home (OOH) sectors) which are demonstrating leadership and best practice on health and sustainability commitments, as well as highlights those which are falling short.

Here we explore some of the key findings from the report, identify the leaders and laggards among the retailers and OOH businesses, and outline what businesses should be doing to improve.

Headline findings:

Exploring some of the findings:

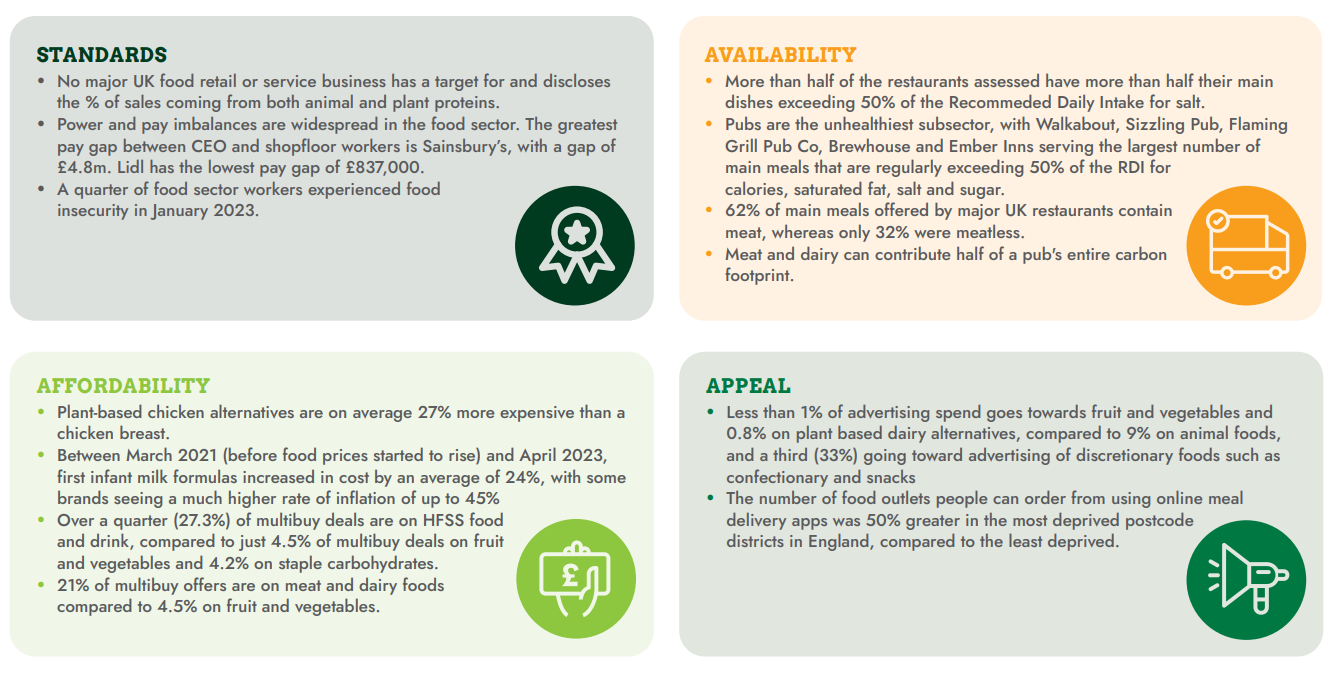

Some of the starkest findings of the report show that:

Businesses aren’t doing enough to help reduce meat consumption.

- No major UK food business has set targets and discloses the % of sales of both animal and plant-based proteins. This is despite many of these businesses having set Net Zero targets. It just won’t be possible to reach Net Zero without reducing sales of animal protein; for example, we found that meat and dairy can contribute half of a pub's entire carbon footprint. Disclosing sales-based data and setting targets are the essential first steps that businesses must take to achieve these goals.

- People want to reduce their meat consumption, however plant-based options come at a premium. For example, plant-based chicken alternatives are 27% more expensive than a chicken breast.

- Animal-based dishes are still the major offering by the OOH sector - 62% of main meals offered by the major UK restaurants contain meat. It’s simple – people won’t be able to choose healthy and sustainable options in the first instance if they are not available. Increasing plant-based offerings on menus is shown to increase sales; a win-win for lowering carbon emissions and contributing to better health outcomes.

Businesses aren’t doing enough to readdress the power and pay imbalances which are widespread in the food sector.

- 14.4% of food sector workers earn the Minimum Wage or below (more than DOUBLE the % of workers across the whole economy) and 25% of food sector workers have experienced food insecurity (more than those in other sectors, like education and healthcare). Yet supermarket bosses are being paid up to £4.8m more than their shop floor workers.

Businesses aren’t doing enough to help us choose healthy food.

- Food companies play a big part in determining our food choices, yet advertising is skewed towards foods that are bad for us. A third of advertising spend goes towards promoting confectionary, snacks, desserts, and soft drinks. This is compared to just 1% towards fruit & veg. Nearly a third of multibuy deals are on HFSS (high in fat, salt, or sugar) food and drink – compared to just 4.5% on fruit & veg.

The leaders and laggards:

Leaders:

- Supermarkets continue to be the best sector overall for setting targets and reporting on them. This is reflected globally – the World Benchmarking Alliance’s Food and Agriculture Benchmark shows retailers are much further ahead of food service companies in setting targets to increase sales of healthier food. Results from our Plating Up Progress analysis showed that:

- 8 companies (Aldi, Asda, Greggs, Lidl, M&S, Sainsbury’s, Tesco and Waitrose) have a target and disclose data for HFSS

- 6 companies (Compass Group UK & Ireland, Sodexo, Lidl, Tesco, Sainsbury’s and Waitrose) have a target and disclose sales of fruit or vegetables across their business.

- Lidl and Sainsbury’s are the only retailers that have targets and report on both HFSS and fruit and vegetables sales and continue to be the leading companies overall within the sector. They are also the only companies in which formal accountability for the company’s nutrition targets lies with the CEO.

- We looked at how much a reasonably healthy packed lunch costs from five of the major retailers, finding that Tesco offer the best value, at £8.30 for a week’s worth of lunchbox items. Tesco was the only one of the five major retailers where the cost of healthy lunchboxes came down between August and October (from £8.39 to £8.30).

- Within the OOH sector, caterers and universities come out as the best subsectors on both health and sustainability.

Laggards:

- Overall, the healthiness of OOH is still worse than supermarkets on health and sustainability. Perhaps unsurprisingly, within the OOH pubs and burger joints are the worst offenders on both accounts.

- Tank and Paddle (part of the Stonegate Pub Company) stood out for poorest performance on healthy food offerings.

- Chicken cottage and KFC had the highest percentage of main meals containing meat on their menus.

- The impact of Meal delivery Apps (MDAs), such as Just Eat, Uber Eats and Deliveroo, is still largely unknown due to lack of data collect and shared by them.

Recommendations:

Overall, more action from food businesses is needed on health and the environment. The climate and health crises require urgent changes to be made. Big companies have a responsibility to citizens to do all they can to help citizens eat more healthily and sustainably, especially as the cost of living crisis continues to amplify health inequalities, with low-income families being most affected.

Specifically, UK food businesses should:

- Measure and report on 3 key metrics to establish healthy and sustainable business portfolios and to help shift consumption patterns. These are:

- Have a target for and disclose % of sales of high fat salt and sugar (HFSS) foods

- Have a target for and disclose % of sales of fruit and vegetables

- Have a target for and disclose % of sales of types of protein (animal and plant)

- As well as setting targets and disclosing % of protein sales, companies need to put in place strategies to reduce meat consumption. These should be equally as ambitious as those set by sister companies in Germany and The Netherlands. At the same time, they should increase the availability of appealing plant-based options and make them more accessible by making them the same price, or cheaper, than animal source foods.

- Make more concerted efforts to ensure staple healthy food items are more affordable. They should commit to the Kids Food Guarantee, a set of actions which we think retailers (and manufacturers) should have in place as a minimum to support families facing food insecurity.

- Focus more of their advertising budgets on promoting foods that are good for people and planet, and less on those that aren’t.

- Put more pressure on the MDAs to be more transparent and share their data with researchers and other stakeholders to help to build a picture of what kind of food is being sold across different regions in the UK and enable the appropriate policies to be put in place.

- Take steps to ensure all their staff are paid properly and become accredited Real Living Wage employers.

Policymakers should:

- Introduce mandatory reporting of sales weighted data to create a level playing field for businesses and signal its commitment to the healthy and sustainable diet agenda.

You can find the full State of the Nation’s Food Industry 2023 report here. For more insights on this report, sign up to our launch webinar on Thursday 30th November at 10.30am, and listen to our podcast episode which will explore its key themes (available from Friday 1st December).