15 November 2023

Analysing reports of ‘greedflation’ by food businesses

Growing reports of ‘greedflation’ amidst the cost of living crisis – the idea that food businesses are driving inflation by raising prices above their costs to make excess profits – prompted us to investigate the truth of this suggestion.

In our briefing on this, we review the current evidence available, as well as conducting a rapid review of the causes and effects of food price inflation in the UK over the last 18 months.

Here we summarise the main findings of the briefing and provide an update on newly released inflation data and what this means in the context of the cost of living crisis.

Main findings

According to the Competition and Markets Authority’s report investigating the effectiveness of competition in the supply chain:

- So far, there is no real evidence of profiteering by supermarkets.

- Average operating profits and margins have actually fallen, mainly due to retailers’ costs (particularly goods, labour and energy) increasing faster than their revenues. This indicates rising costs have not been passed on in full to consumers.

- Consumers are continuing to switch to the discounters to find lower prices (both Aldi and Lidl have gained market share), suggesting supermarkets are unable to keep prices artificially high without losing business.

- There is still some uncertainty, however; the next phase of the CMA's investigation will focus on supply chains and pricing within specific product categories such as infant formula (read our latest report on this), and whether weak competition could be contributing to food price inflation.

Our own research, comparing Producer Price Inflation (changes in prices of goods bought and sold by UK manufacturers, including input costs and factory gate costs) and Consumer Price Inflation (changes in prices of goods and services bought by households) data from the Office of National Statistics found:

- There is a significant time lag between PPI rates declining and CPI starting to reduce. Although the rate of output PPI rates for food is now slowing, we are yet to see a notable drop in CPI rates for food.

- This could be explained by the long term, fixed price contracts that producers are locked into, meaning that slowing input inflation rates will take a while to flow through the supply chain and start to impact on consumer prices. Currently many producers can't sell at lower prices till their current contracts end.

- Labour costs rose over this period (a major inflation driver) which could also be a reason for retailers to delay price reductions even as PPI rates come down.

- Monitoring the gap between PPI and CPI rates as inflation slows will be key, as this is the point at which manufacturers and retailers may look to rebuild their operating profit margins at the expense of bringing the price of consumer staples down (though this might be difficult to do without losing market share).

November update

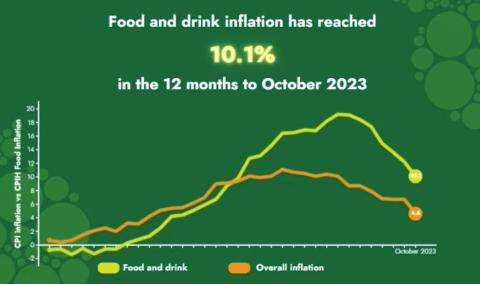

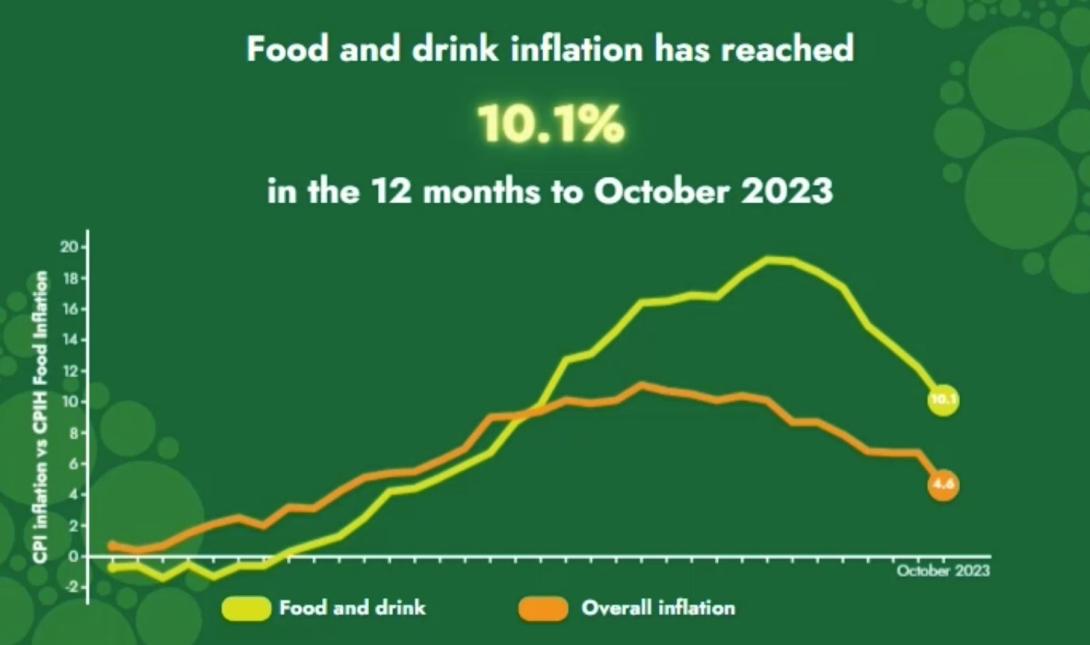

General inflation is at 4.6% in the year to October 2023, down from 6.7% from last month.

See below for an updated graph which compares CPI and PPI data. Prices of food and non-alcoholic beverages was at 10.1% in the year to October 2023 according to the latest Consumer Prices Index. Producer Price Inflation is at 3%.

This shows there is still a large gap between the PPI and CPI indices; consumer prices are not falling as quickly as producer costs are.

This is likely to be influenced by the expected time lag between producer and retail prices as supplier contracts gradually start to come to an end.

However, the gap could also indicate that retailers and manufacturers are delaying passing on price cuts (due to slowing inflation) to recoup costs and increase profit margins. This needs to be closely monitored in the coming months.

The Bank of England has now said that a rebound in corporate profit margins over the next year could prevent inflation falling as quickly as expected.

Its research found that on average, companies were on course to increase margins to just under 10%, their highest ever level, and most are signalling that though they will benefit from falling costs – for energy in particular – they will not pass that benefit on in the form of price cuts.

We'll be continuing to track grocery prices, and PPI vs CPI inflation data, as part of our Food Price Tracker monthly blogs which you can find here.

We are also calling on retailers to support low-income households with children to access and afford healthy staples foods. You can find out more about the Kids Food Guarantee here.

Future food price volatility

Although inflation appears to be slowing after peaking in April of this year, this downward trend may be reversed in the coming months.

The devastating Israel/Hamas war has shocked the world over the last month. A secondary outcome of the conflict could be spiralling global fuel and food prices if the war escalates across the Middle East.

Oil prices are already rising due to global market fears, which is likely to push up fuel prices in the coming months, and a severe oil price shock would likely lead to a fresh bout of food price inflation worldwide.

Other factors that are likely to affect food prices going forward are extreme weather, as explained in our September Food Price blog, as well as the continuing conflict in Ukraine.