18 November 2024

Why the UK's food system isn't working and how we can fix it

Which UK food businesses are supporting the transition to more healthy and sustainable diets and what needs to happen next? By Food Foundation Project Officer Alice English

The State of the Nation’s Food Industry report shines a light on major food businesses from the retail, manufacturing and Out of Home (OOH) sectors operating within the UK.

Acknowledging the important role these sectors play in shaping our food environments and eating habits, the report uses 11 metrics to assess which companies are leading the way, which are falling short, and – most importantly – what businesses should be doing to help fix our broken food system.

The report draws largely on our latest Plating Up Progress update, The Food Foundation’s benchmark which assesses the health and sustainability credentials of 36 major UK operating food businesses including retailers, the OOH sector, wholesalers and manufacturers.

This group of companies is responsible for most of the food we buy, with over 90% of retail sales funnelled through the supermarkets assessed in our benchmark.

This year's report shows that businesses are not doing nearly enough, fast enough, and we cannot continue to leave progress on healthy and sustainable sales to the market.

This approach has categorically failed to shift the dial and food businesses are trapped in a system that rewards the status quo. The government now needs to bring in regulation that raises the standard for all businesses.

Here we explore some of the key findings from the report, identify the leaders and laggards among the retailers and OOH businesses, and outline what businesses should be doing to improve.

Exploring some of the key findings

Businesses aren't doing enough to sell healthier food... especially the OOH sector.

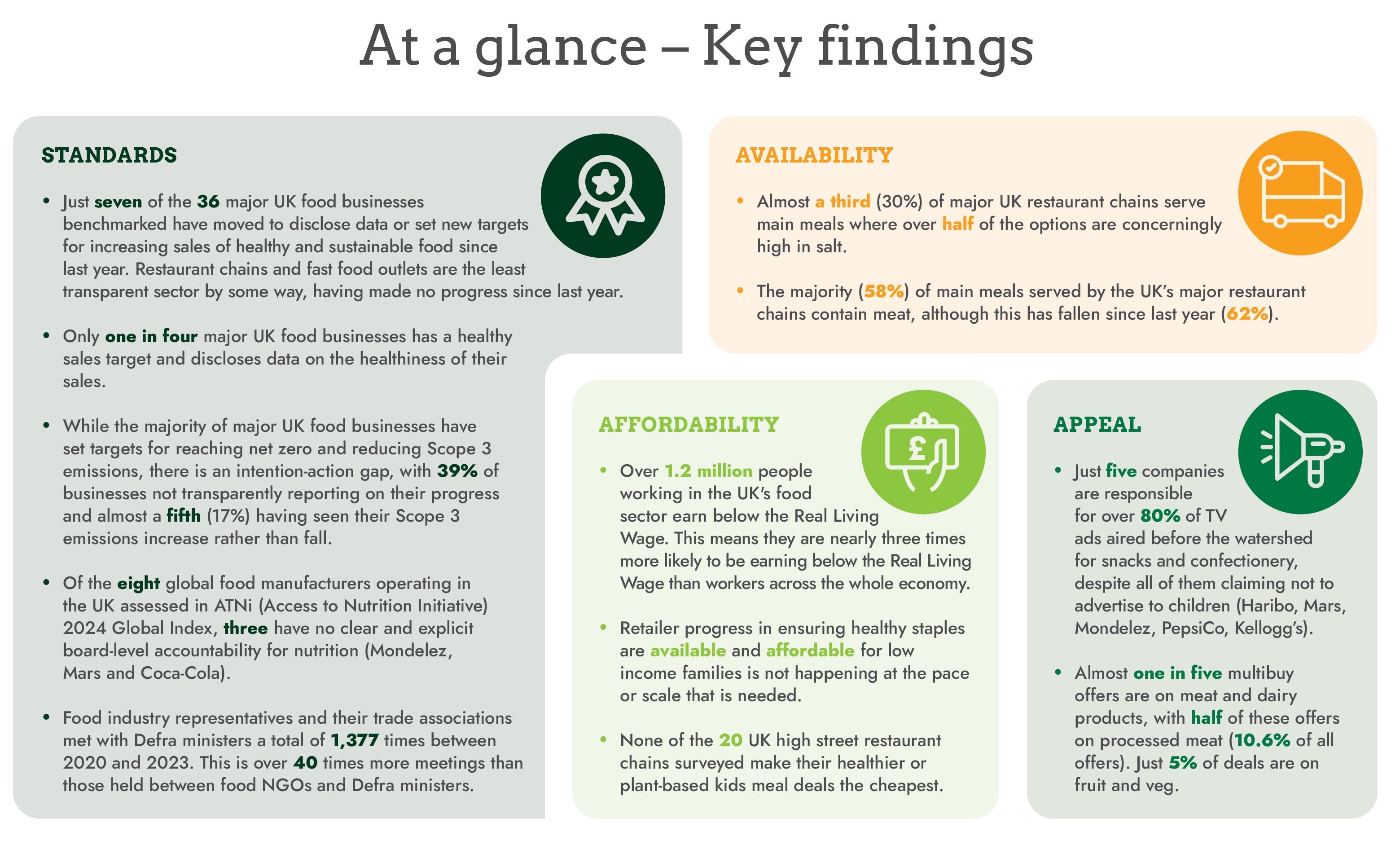

- Less than a third of major UK food businesses have a healthy sales target or disclose data on the healthiness of their sales. Just four (11%) businesses (all of which are retailers) have a sales-based target and disclose data for fruit and veg.

- Restaurant chains and fast-food outlets are the least transparent sector by some way, having made no progress since last year in disclosing healthy sales data or setting targets to improve the healthiness of menus. Almost a third (30%) of major UK restaurant chains serve main meals where over half of the options are concerningly high in salt.

- The progress on climate commitments is likely being driven by the increasing number of corporate reporting directives requiring businesses to publicly disclose data on their environmental impact. This is in stark comparison to the lack of regulation and absence of reporting directives on the healthiness of portfolios.

Businesses aren’t doing enough to help us afford healthy food

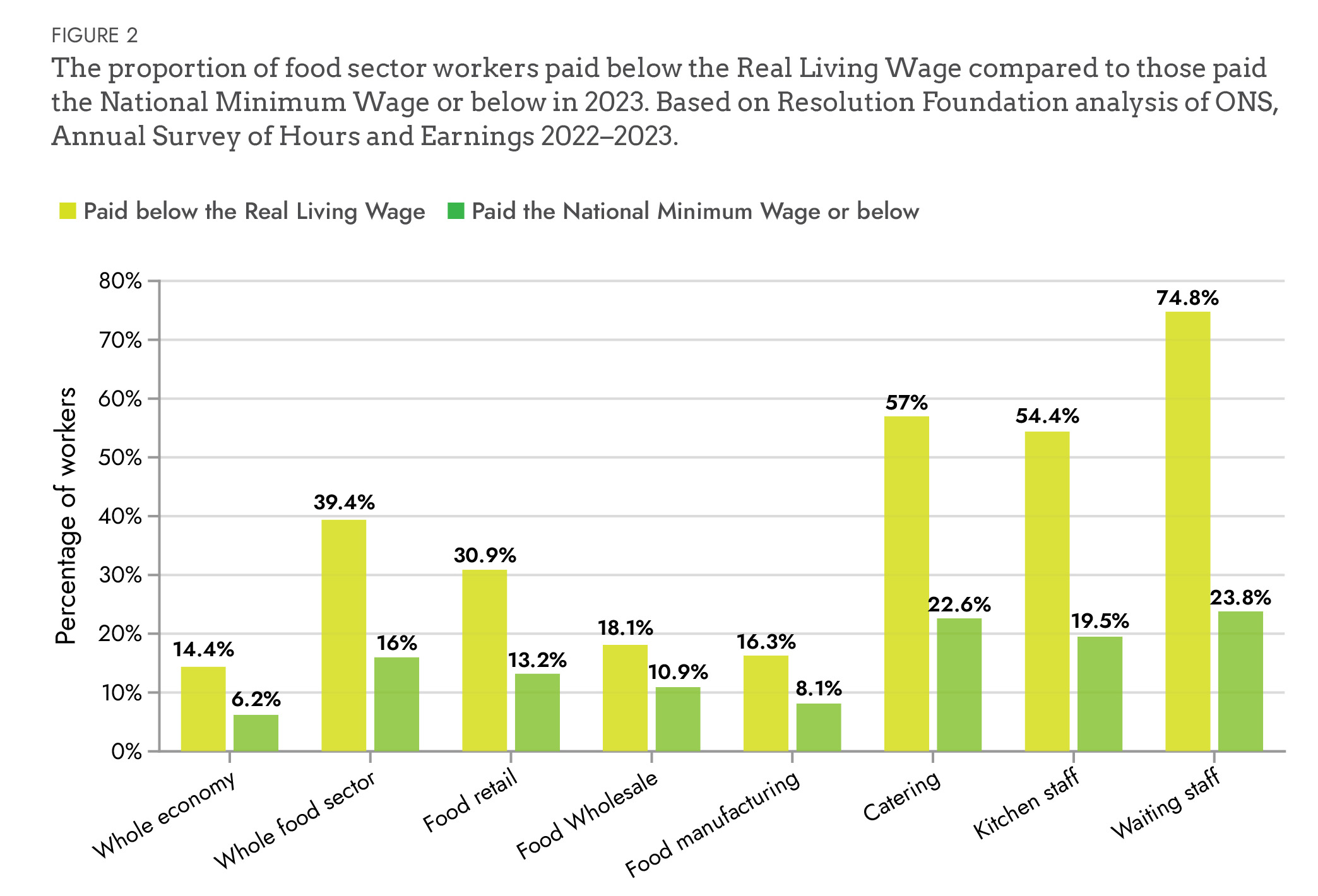

- Over 1.2 million people working in the food sector earn below the Real Living Wage. This means they are nearly three times more likely to be earning below the Real Living Wage than workers across the whole economy.

- None of the 20 major UK high street chains surveyed make their healthier or plant-based kids meal deals the cheapest.

- Food businesses are simultaneously some of the largest employers in the UK and are the channel through which most people in the UK buy their food. They therefore play a critical role in helping people to afford healthy food and reducing the health inequalities we see in our society because of poor diets.

There's an intention-action gap when it comes to businesses reducing their carbon emissions.

- While there has been some progress on climate commitments, with the majority of major UK food businesses having set targets for reaching net zero and reducing Scope 3 emissions, this is not translating into action. 42% of businesses are not transparently reporting on their progress and almost a fifth (17%) have seen their Scope 3 emissions increase rather than fall.

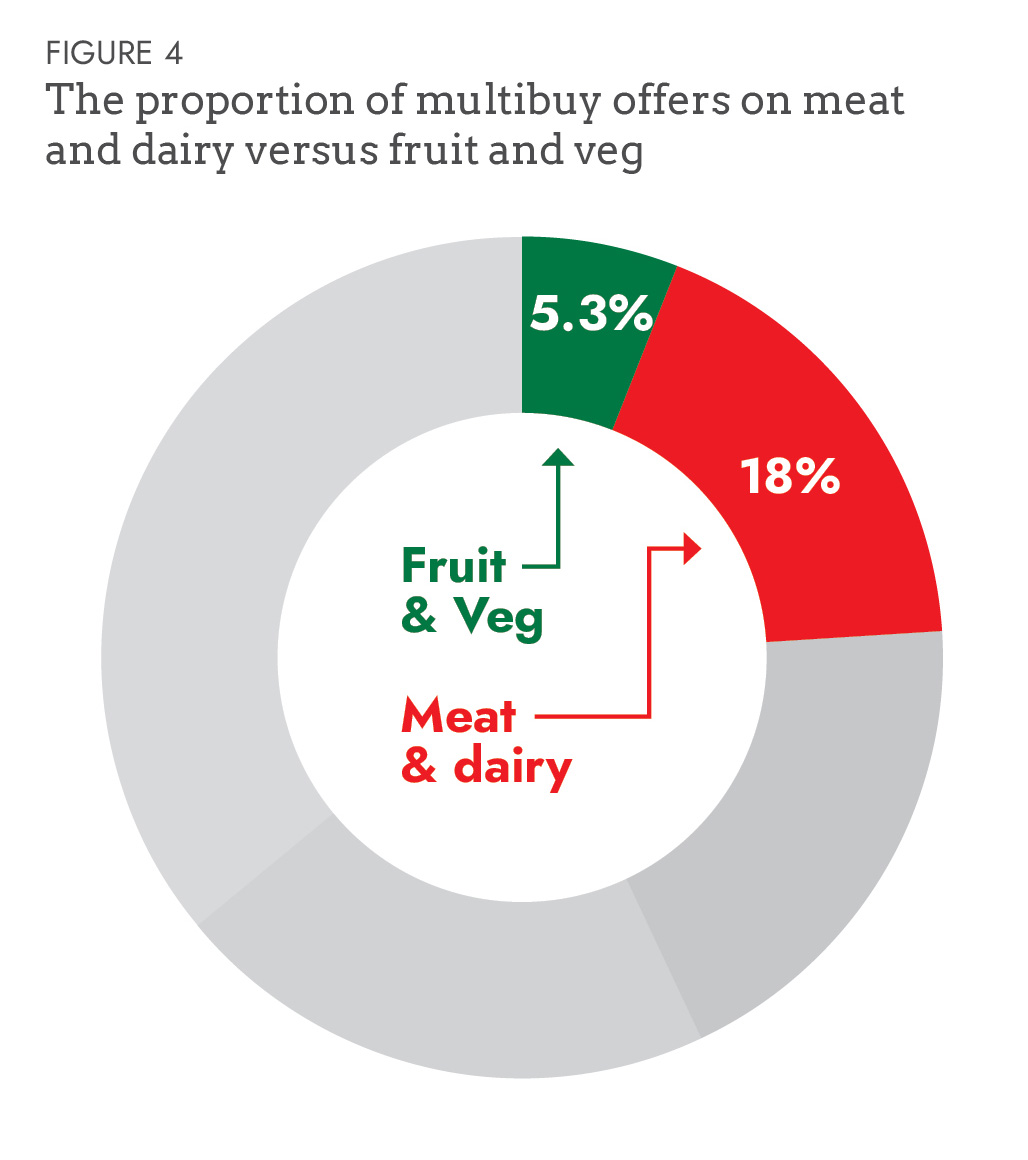

- Scope 3 emissions make up around 90% of food businesses’ overall carbon footprint (Defra, 2024). For food retailers, meat and dairy make up 51% of all Scope 3 emissions (Madre Brava, 2024). So, to reach net zero, businesses will have to reduce the amount of meat and dairy they sell. Despite this, almost one in five supermarket multibuy offers are on meat and dairy products and one in 10 price promotions.

- Food is increasingly on the agenda following last year’s COP, and the UK is failing to reduce food system emissions fast enough, lagging behind other sectors.

- With just six years until we reach 2030, the point at which the UK needs to have reduced our emissions by 45% if we are to reach net zero by 2050, businesses need to make their boards accountable for delivering on climate targets, and policymakers need to provide direction and incentives for companies to do this.

The leaders and laggards:

Leaders:

- Lidl GB and Compass Group UK & I are the only companies with targets to increase sales of plant-based protein in proportion to animal-based protein. By setting these targets the companies are both driving efforts to shift diets while also reducing their Scope 3 emissions. Bidfood has also made substantial progress this year in moving to disclose data about the healthiness and sustainability of their food sales.

- Tesco performs most strongly of all UK supermarkets in supporting low income families to afford healthy staples. Driven by their healthy sales target and better baskets initiative, Tesco perform strongly on the pricing and availability of healthy basics such as fruit and veg and recently launched a new kid’s size plain yogurt multipack. They have also consistently been the most economical place to purchase healthy packed lunch items.

- Two manufacturers, Nestlé and Unilever, hold Real Living Wage accreditation. Of the 36 companies assessed in Plating Up Progress, only 11 (31%) pay the Real Living Wage. These are mostly retailers, though none are formally accredited as Real Living Wage employers.

- Danone. According to analysis by Bite Back, Danone Group make just 2% of their UK sales from HFSS products. Outlined in the Danone Responsible Marketing Principles is an acknowledgement that marketing communications can influence the purchasing behaviour of under 12-year-olds. In 2024, Danone further enhanced its commitment to responsible marketing by adhering to the government-endorsed Health Star Rating (HSR) system to determine which Danone products can be used in marketing communications to children.

- Aldi have a policy of everyday low prices rather than temporary volume and price promotions, and where they do run offers, these are geared towards promotion of fruit and veg (such as their Super Six price promotion). Their ‘Healthy and Sustainable shopping basket’ initiative with the BDA provides customers with practical support for shopping for healthier and more sustainable diets on a budget and contains five times more plant protein than the average diet.

Laggards:

- No progress has been made in the quick service and restaurant sectors, which continue to lag far behind the retail sector.

- 15% of Iceland’s multibuy deals are on processed meat while barely 2% of their multibuy offers are on fruit and veg and staple carbohydrates. Overall, Iceland is the supermarket with the highest proportion of price promotions on processed meat (7.3%).

- Tank and Paddle (part of the Stonegate Pub Company) stood out (for the second year running) for poorest performance on healthy food offerings.

- Chicken Cottage’s menu is the worst performing for the second year running in terms of plant-based options, with 100% of its main dish offerings containing meat and zero plant-based options available.

- Just 5 companies (Haribo, Mars, Mondelez, PepsiCo, Kellog’s) are responsible for over 80% of TV ads for snacks and confectionary aired before the watershed, despite all of them claiming not to advertise to children.

- Global food giants Mondelez, Mars and Coca-Cola still have no clear explicit board-level accountability for nutrition.

Recommendations:

Businesses:

- Set healthier and more sustainable sales-based targets and publicly disclose performance annually against these targets.

- Join other progressive businesses who have been speaking publicly about the need for government to put in place the necessary frameworks and policies required to level the playing field, starting with publicly calling for mandatory reporting of health and sustainability sales data.

- Set SBTi accredited targets for reducing Scope 3 emissions and disclose data on progress annually against a baseline year.

- All food businesses ought to gain Real Living Wage employer accreditation.

- Businesses ought to review their membership of different trade bodies to check for any (mis)alignment of positions and strategy and commit to taking action to address any misalignment in line with the Responsible Lobbying Framework.

- Retailers, manufacturers and food service operators should aim to increase their sales of fruit, veg, beans and plant proteins and reduce sales of meat and HFSS products. Advertising and promotional spend should be rebalanced to support this transition.

- Retailers should offer lower prices on healthier and more sustainable options within meal deals to make them more financially appealing to customers. They should offer healthy children’s lunchbox meal deal items that are compliant with School Food standards and make up five lunches that can be bought at affordable price point, for example through a multibuy deal.

- Retailers should promote the Healthy Start Scheme. Actions to support increased uptake could include; labelling foods included within the scope of Healthy Start with information about the scheme, running targeted instore and/or online communication campaigns to promote the scheme to low-income customers, and exploring the potential to use loyalty card schemes to incentivize the use of funds on healthy foods.

- Manufacturers should get ahead of the incoming restrictions on the advertising of HFSS products on TV and online before October 2025 by restricting any adverts that are currently run on HFSS food and drink.

- Out of home and food service businesses should increase the ratio of plant-rich to meat-rich options on menus and reduce the amount of meat within meat-heavy dishes. Retailers and restaurants ought to encourage uptake of plant-based options by including these within meal deal offerings to widen the appeal of plant-based options (WRI, 2024).

Policymakers:

UK food businesses are trapped in a system that rewards the status quo. The lack of regulation to raise standards and create a levelling playing field means that progressive businesses are limited in how far they can go in a system that makes investment into healthy (and sustainable) products a commercial risk. Government ought to regulate to raise standards and set a clear direction of travel for industry.

- Policymakers should introduce consistent and transparent mandatory reporting of health and sustainability data by all large food businesses through the Food Data Transparency Partnership.

- They should also look to substantially improve the disclosure requirements for meetings between the food industry and policymakers. Registers of meetings should be accessible, easily searchable, and include accurate information on meeting objectives with more detail on issue(s) addressed and regarding what specific policy or legislation. Two countries and one US state – Canada, Ireland and Washington State – offer examples of more robust lobby registers that could be emulated (Lobbying.ie, 2024; Solaiman, 2024).

You can find the State of the Nation’s Food Industry 2024 report here. For more insights on this report, watch our launch webinar or listen to our upcoming podcast which explores its key themes.