19 January 2022

Food Prices Tracking: January Update

by Shona Goudie and Rebecca Tobi

(For the most recent update see here)

Food price inflation over recent months is an area of growing concern. In this update we look at what has happened to food prices in the past month and what we might expect to happen next.

What has happened over the past month?

Overall Inflation in the UK

The Consumer Price Index (CPI) rose by 5.4% in the 12 months to December 2021, up from 5.1% in November1. Between November and December 2021, the CPI increased by 0.5%, with food and drink as a category one of the largest contributors to the recorded increase.

The 12-month inflation rate of 5.4% is the highest increase seen in the ONS’s current National Statistics data series since it began in January 1997, with the ONS noting that the last time inflation was higher was in March 1992 - almost 30 years ago.

Inflation predictions for the coming year have increased even higher, with many now referring to a ‘cost of living crisis' 2,3. The Bank of England has revised previous predictions that inflation would not hit 5% until April 2022, now predicting it will hit 7% - the highest level since 19914.

UK Food Prices

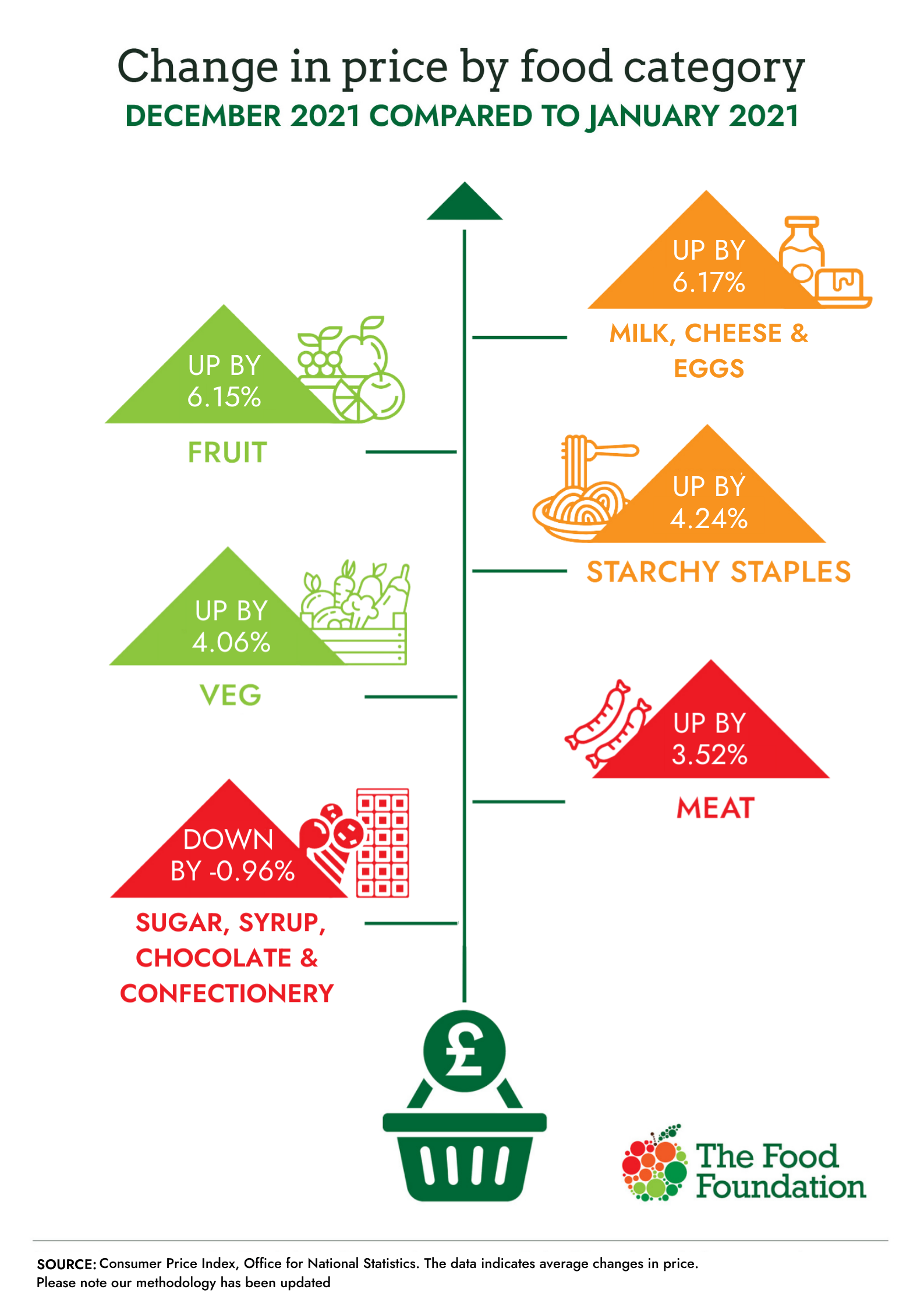

New CPI data out this week charting take-home retail prices during December 2021 for commonly purchased food and drink items shows that prices have risen 4.4% compared to January 2020, and by 3.9% over the course of previous 12 months (since January 2021).

Prices rose in December for all major food categories monitored, expect confectionery. The price of starchy staples (which form the bulk of our diets in the UK) is now 4.2% higher than in January 2021– likely due in part to an increase in global wheat prices caused by poor harvests in 20205. The price of meat also increased in December (up 3.5% compared to January 2021) with the cost of lamb jumping almost 10% compared to the start of the year. Lack of supply appear to be driving the increase in the price of lamb, although rising input costs for farmers may also be a factor6,7. It remains concerning to see the cost of both fruit and vegetable increase for the fourth month in a row. Vegetables are now 4.1% higher than they were in January 2021, and the cost of fruit has increased by 6.2% during the same period of time.

The CPI data is corroborated by Kantar data covering the four-week period up to Christmas, which showed that food prices rose by 3.5% with the average monthly food bill now £15 more expensive. And it seems that 2022 will see a continuation of this upward trend, with The Grocer reporting that almost 10,000 products increased in price over the new year, with an estimated 6% of all supermarket products becoming more expensive between 27th December and 5th January8. Furthermore, the BRC-NielsenIQ Shop Price Index for December indicates that food inflation is accelerating at a faster rate than the wider retail sector9.

Global Food Prices

The FAO’s food price index, which tracks global food prices for key commodities, recorded a slight drop in December, with prices down 1.2 points (0.9%) from November 2021. Aside from dairy products, which saw a month on month increase of 1.8%, the price of all other key commodities fell slightly or remained much the same as in November. However, it is worth noting that overall food prices remain high – with the global food price index 23.1% higher compared to December 2020. Looking at 2021 as whole, global food prices were 28.1% above 2020 prices, with reports from low and middle income countries suggesting that many families are already struggling as a result, with Sri Lanka, Turkey and Bangladesh battling soaring inflation in part due to increasing food costs10,11.

Food Shortages

While food shortages are a global issue, the UK appears to be worse affected than the rest of Europe. A YouGov poll in December found that 56% of Brits have experienced food shortages in shops, considerably higher than in other countries in Europe where the numbers reporting shortages ranged between 6-18%12. Experts believe the UK is worse affected due to labour shortages resulting from Brexit13.

There are concerns that the effects of Brexit on the UK’s food supply will continue to be seen in coming months. At the start of January, changes to custom checks due to Brexit were introduced. A supply chain trade body has warned this could cause supply chain problems, leading to increased prices, less flexibility and delays14,15.

According to the British Growers Association, some growers in the UK have planted fewer crops due to increased costs and in anticipation of continued labour shortages to avoid food being left to rot on farms, as was seen in 202116. The Government has now extended the seasonal farm work visa scheme to help mitigate these concerns. Cabinet Minister, George Eustice has also acknowledged the challenges facing farmers due to increased input costs, but has said that this should increase farm gate prices paid by supermarkets ensuring higher incomes for farmers, but not resulting in food inflation for consumers17. Wages have increased in some areas of the food system due to labour shortages driving up demand. While this is a positive, it may begin to have an impact on food prices18.

What could happen next?

The drivers of increasing food prices in recent months including labour shortages, and increased transport and input costs (see our previous blog for more on this) are likely to continue into 2022.

The British Chambers of Commerce conducted a poll finding that 77% of manufacturing companies and 74% of retailers and wholesalers were expecting price rises in the next three months (although these increases are not specific to the food industry)19.

Similarly, supermarkets have warned that price increases should be expected in 2022 due to supply chain problems and rising commodity prices and transport costs, with Tesco saying they face an increase in inflationary pressures by as much as 5%20. The British Retail Consortium have also warned that prices will continue to rise and at a faster rate than last year as retailers struggle to absorb increasing costs. However, despite this, many of the larger supermarkets have assured customers they will endeavour to keep prices down 21,22,23.

The Cost of Living

Increases in food prices will not be the only factor affecting people’s ability to afford food in the coming months. The cost of living is an increasingly big concern for many, with 2022 nicknamed “the year of squeeze”. Rising energy bills puts pressure on food budgets which are more easily squeezed.

Increases in inflation in the past few months have already started to impact on people’s ability to afford food. Even before Christmas, food banks were facing increased demand (and decreased supply). A survey by IFAN in December found 90% of the foodbanks in their network have experienced increased need. The removal of the £20 uplift to Universal Credit and the increase in energy bill prices have likely been substantial drivers. Approximately 15 million households saw their energy bills increase by 12% when the cap was raised in October 202124. A recent Observer poll found 12% of voters reported their financial situation as ’struggling’, an increase of 3 percentage points since April. 86% reported an overall rise in the cost of living and almost as many (83%) reported noticing a rise in food bills25.

Unfortunately, the situation is likely to deteriorate further in 2022. April will likely add further pressure for many citizens as the cost of living will rise again overnight . The cap on energy bills (reviewed every six months, with the next announcement due 7th February) is predicted to dramatically increase from £1277 to £2000 in April when a rise would be implemented. The Resolution Foundation predict that this will treble the number of families experiencing fuel poverty, and is likely to be worse in the North East and West Midlands26. This would see the poorest 10% of households have their energy spend rise from 8.5% to 12% of their total household budget27, while The Joseph Rowntree Foundation have predicted energy bills could be as much as 18% of income for a low-income family28. This is likely to be a long-term issue, with estimates that gas prices will remain high for the next two years29.

Food is often the first place where costs can be cut when disposable income is tight. If increased expenditure in other areas such as gas bills is needed, many will have less money for food, sparking concerns that they will have to choose between eating or heating.

April will also see an increase in National Insurance tax which is set to rise by 1.25%. This will cost the average household £600 more a year30. According to the most recent findings from the ONS, in November wages in real terms decreased for the first time in over a year: despite average total earnings increasing by 4.2%, in real terms (i.e. once adjusted for inflation) wages decreased by 0.9%31. Earnings are expected to continue to fall throughout most of 2022.

For the lowest paid this will be slightly offset by increases in the minimum wage, also due to be implemented this April. Social security payments are also due to be uprated by 3.1% in April. However, the Institute of Fiscal Studies have said that to keep up with inflation, twice as big an increase is required32.

Furthermore, the Household Winter Support Fund through which Local Authorities have been able to provide support with paying for food and fuel for many low-income households, will come to an end in March.

The combination of reduced real incomes and an increased cost of living - including higher food prices - is going to put very real pressure on the ability of many UK citizens to be able to afford sufficient food and healthy food in the coming months which in turn is likely to exacerbate already worrying levels of dietary inequality. The Food Foundation will be continuing to track levels of food insecurity with our next release in February.

For more information on food prices, see our Food Price Tracker.

The next update will be published on 16th February.

Shona joined The Food Foundation as a Project Officer in 2019 and has worked on research, policy and advocacy across a range of projects over that time including leading our food insecurity surveys and flagship annual Broken Plate reports. She now works across the charity's policy portfolio including our children's food campaigns, food insecurity and food environments. She is a Registered Associate Nutritionist with a background in clinical nutrition who worked in dietetic departments in NHS hospitals before joining The Food Foundation.

Rebecca joined the Food Foundation in January 2020, leading on the Peas Please initiative. These days she manages our food business transformation team, with oversight of our work engaging food businesses, investors and policy-makers with the need to transition the UK towards a more sustainable and healthy food system. This includes our Plating Up Progress and bean projects.

Rebecca is a Registered Nutritionist (RNutr) with a background in science communication, joining the Food Foundation from the Nutrition Society. In a previous life, Rebecca worked in the marketing and tech sectors before deciding to move into nutrition, obtaining a MSc in Nutrition for Global Health at the London School of Hygiene and Medicine.

Rebecca is a bean obsessive, a staunch advocate for evidence-based nutrition communication, and is passionate about the structural changes that make healthy and sustainable diets accessible for all.