Kids Food Guarantee: First Infant Milk Formula Update October 2024

Kids Food Guarantee: First Infant Milk Formula Update. October 2024

First infant formula prices remain high: the most expensive first infant formula on the market is now twice as expensive as the cheapest first infant formula available despite being nutritionally comparable.

Why does the affordability of first infant formula matter?

Food insecurity remains rife in the UK, with particular challenges for families with young children, yet prices of first infant formula remain high. The Food Foundation’s Kids' Food Guarantee is calling on policy makers, manufacturers and retailers to do more to mitigate the impact that inflation has had on first infant formula prices and ensure prices are affordable for all.

Food insecurity leaves babies who are partially or exclusively dependent on first infant formula particularly vulnerable(1). For babies aged under six months, breastmilk or first infant formula for those families reliant on formula are a baby’s sole source of nutrition and hydration.

Yet one in four (26%) mothers of babies and infants said they struggled to afford formula in January 2024.

Reported behaviours to make formula stretch further such as watering down feeds, increasing the time between feeds, and substituting formula with other milks which are not appropriate for babies under 12 months of age, mean that babies in these circumstances are at high risk of undernutrition during a critical period of growth and development.

What’s changed since the start of the year?

The Kids Food Guarantee has been monitoring the price of first infant formula at the nine major UK retailers since April 2023.

Ahead of the Competitions and Market Authority’s (CMA) forthcoming report exploring pricing and competition within the infant formula market - triggered by concerns raised in their previous report about manufacturers pushing prices up above input costs - we revisited the price of first infant formula brands in October 2024.

The biggest positive shift since February is that there are now three first milk formula products available in standard tins (800g) that are affordable with the weekly £8.50 Healthy Start government funding provided for eligible children under one.

- Aldi’s own-label Mamia brand

- SMA’s Little Steps brand

- Lidl’s newly launched own-label Lupilu first infant formula

The launch of Lupilu is hugely welcome as it means there are now two own-label formulas available for caregivers to buy. Own-label products are products carried exclusively by the supermarket that owns them and are generally cheaper than branded goods despite being of comparable or identical quality.

However, although some progress has been made in driving down the cost of infant first milk, formula prices remain high overall and there is still a concerning variation in pricing across the retailers for individual products and brands.

Supermarket price reductions appear to remain primarily driven by Iceland’s leadership in this space and their campaign around infant formula, which has led to Iceland reducing the price of products within both the Aptamil (in January) and SMA Little Steps (in February) brand ranges, with the rest of the retail sector swiftly following suit on both occasions.

Danone moved to reduce the price of products in their Aptamil brand range in January following the CMA’s critical report of competition within the formula market in November 2023, with Iceland the first retailer to pass the reduction in wholesale price onto consumers.

A similar domino effect can be seen with Nestle’s SMA Little Steps brand, where Iceland’s move to cut costs in February 2024 appears to have led to similar price reductions for certain products in this range across the retail market. This means that a standard tin of SMA Little Steps is now available within the weekly Healthy Start budget.

- Standard size tins of SMA Little Steps (800g) now retail at £7.95 at all retailers except for Ocado, who as of October sold the product at £9.75. This represents a price reduction of £1.80 at Morrisons, Sainsbury’s and Tesco since February, and a reduction of £3.55 at Co-op(2). (Morrisons had initially reduced the price of SMA Little Steps to £7.90 in April, however the product is now sold at £7.95 in line with other retailers).

- Aldi have also reduced the price of their own-brand Mamia First Infant Milk product. Their 800g product retails at £7.09, which remains the cheapest product on the market and represents a significant 11p price reduction per 100g since February.

- Lidl’s new Lupilu own brand formula was introduced in stores last month. 800g tins of the product price match Aldi’s Mamia, retailing at £7.09, which is a huge step forward in increasing access to affordable formula. Note: Lupilu has not been included in our monitoring of online prices as Lidl does not include the product on its website.

Despite the encouraging falls in price for the SMA Little Steps and Mamia products, and the introduction of Lupilu, progress seems to have stalled since the publication of the last CMA report in November.

The fall in the price of SMA Little Steps branded products is the main driver of those price changes we have seen since February, with little movement across all other brands where prices have remained static. There is also still a wide range of pricing across different retailers for the same brand.

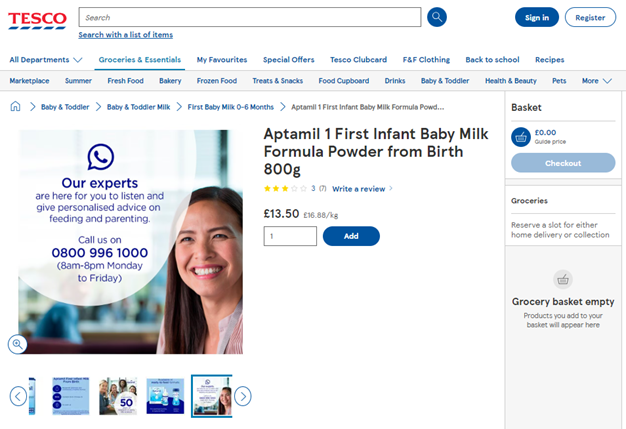

- The price of Aptamil 1 First Infant Milk From Birth (800g) is 25% higher at Co-op where it retails for £14.00 compared to Iceland where the same product is £11.20

- Cow & Gate 1 First Milk Powder (800g) retails at £10.50 at Asda, Morrisons, Ocado, Sainsbury’s, Tesco and Waitrose, while at Co-op it is £10.75 and £9.75 at Iceland

The most expensive powdered(3) first infant formula product on the market (Co-op’s Aptamil 1 First Infant Milk From Birth 800g) is twice as expensive as the cheapest first infant formula product available (Aldi’s Mamia brand 800g).

This variation in pricing within the first infant formula market is concerning given that all products are nutritionally comparable. All first infant formula products on the UK market must comply with regulations on nutrition composition which means they are all judged to be safe and suitable to support adequate growth and development.

Advertising of first infant formula

October’s analysis also identified that several retailers are promoting first formula manufacturers’ marketing materials on their online webshops which are against the WHO International Code of Marketing Breast Milk Substitutes.

Unicef's summary of the code states that "manufacturers and distributors should not engage in any form of promotion related to breast milk substitutes...this includes....establishing parent clubs and helplines."

Specifically, Tesco, Morrisons and Ocado are passing on promotion of Aptamil and Cow & Gate careline information within product information on their online webshops.

It is unclear from the Aptamil promotional materials as to who is responsible for their helpline as it is unbranded. Parents may not therefore realise it is run by Aptamil (a Danone brand).

Screenshot of careline materials featured in carousel of product images on retailer webstore: https://www.tesco.com/groceries/en-GB/products/301359904?productId=301359904

Screenshot of careline materials featured in carousel of product images on retailer webstore: https://groceries.morrisons.com/products/cow-gate-1-first-baby-milk-formula-from-birth/109888832

Infant formula brand initiatives like these carelines are described as “hidden marketing” in a recent international study of the impact of marketing of breast-milk substitutes on infant feeding decisions and practices. The research describes carelines as a marketing tactic that formula companies use to build relationships with mothers by offering a direct line of support, positioning themselves as a parent’s supporter and friend (see also research by the University of Stirling).

Brands and retailers must not be allowed to potentially undermine breastfeeding through these initiatives and their promotion, while the government must continue to ensure that adequate support and advice on infant feeding that is free from commercial influence is available for both those who choose to breastfeed and those using first infant formula.

Recommendations for retailers and manufacturers

- As input costs and inflation continue to fall, businesses must ensure that price reductions are passed on as fully as possible to customers to increase access to affordable first infant formula

- Continue to promote the Healthy Start scheme to low-income customers to ensure families are able to access healthy essentials

- Do not market first infant formula promotional materials such as advertising carelines on websites, as these fail to protect families and their decisions around feeding from undue commercial influences

Recommendations for the Government

- Explore pricing policies that ensure first infant formula is affordable for those that need it.

- Increase the value of the Healthy Start allowance in line with inflation, expand eligibility to more families in need, and increase uptake to ensure no eligible families miss out.

- Ensure families eligible for Healthy Start are auto-enrolled on the scheme.

- Improve communication and information about the nutritional comparability of first infant formula to parents.

- Strengthen the UK law on the marketing of breastmilk substitutes, in line with WHO’s International Code of Marketing of Breastmilk Substitutes, including by closing loopholes which permit hidden marketing through initiatives like carelines. These are legal but against the Code.

- Increase financial support for local authorities to provide breastfeeding support services for all parents.

References

(1) A large number of complex barriers and a lack of support mean that exclusive breastfeeding is not always possible for many parents and caregivers in the UK, see the Food Foundation’s report Breaking down the barriers to breastfeeding to support healthy weight in childhood.

(2) Price data was not gathered for Asda SMA Little Steps in February 2024.

(3) Ready to feed products and tabs are more expensive than powdered first infant formula.

Appendix: Methodology

Kids Food Guarantee

To evaluate formula prices, we selected six standard first infant formula milk products sold in the UK and then found the price of these brands as listed online at each of the nine major UK retailers: ALDI, Asda, Co-op, Iceland, Morrisons, Ocado, Sainsbury’s, Tesco, and Waitrose.

For families looking for the best offers available, in-store prices can be lower than the price of equivalent products online, but in order to compare like for like we have used online prices. This analysis also does not include the value packs that some companies produce (e.g. 2 * 600g packs).

Data is collected at the start of every month. We compared the price in October to the prices of the same products in February when we published our last update. We looked at the price of formula sold in larger tins (typically containing 800-900g of formula) rather than in smaller portion sizes, or per 100ml, as this provides a more realistic reflection of typical shopping behaviour. For further details on our methodology please see our technical report